Saving money is one of the most popular new year’s resolutions. Right up there with losing weight and taking up a new hobby. Ironically, it’s also one of the most broken resolutions! Let’s face it – budgeting is not always easy. Life can get in the way and managing money can feel quite stressful. Sometimes it’s easier to protect our anxiety levels than face the music and check the balance on screen. There’s a handful of budgeting apps out there to help you manage your spending. So we’re going to run through our top 3 to help you and your family reach your financial goals.

Thanks to contactless cards, making payments has never been easier – or faster, for that matter. We live in a paperless world whereby the tap of a card, we can quickly pay for our weekly food shop, a coffee or an impulse buy. And with the contactless card limit increasing to £100 on the 15th of October, your bank account may be at risk of experiencing a couple of financial frights this Halloween.

Christmas isn’t the only reason that winter is one of the most expensive seasons for households across the country. As it gets colder and darker outside, the heating and lights are on for longer, and we spend more and more time in front of the TV. Inevitably, energy bills go up and it becomes harder and harder to stretch your paycheque each month.

However big or small, being in debt isn’t a nice feeling for anyone. The worries around being in debt can consume our thoughts 24/7, taking a toll on both our physical and mental health. You may be surprised by the scale of the impact that debt can have on your health. We’ll explain how and suggest the best services to turn to if you’re struggling.

Becoming a parent really is life-changing. Whether you are in the exciting stages of preparing for your baby to arrive, or whether you are finding your feet and settling into parenthood, the family finances may well be on your mind. With all this added responsibility comes a fair few added costs. It’s important to prepare for this financial change as much as you can. That way, you can focus on enjoying your little one grow up rather than stressing over the bills.

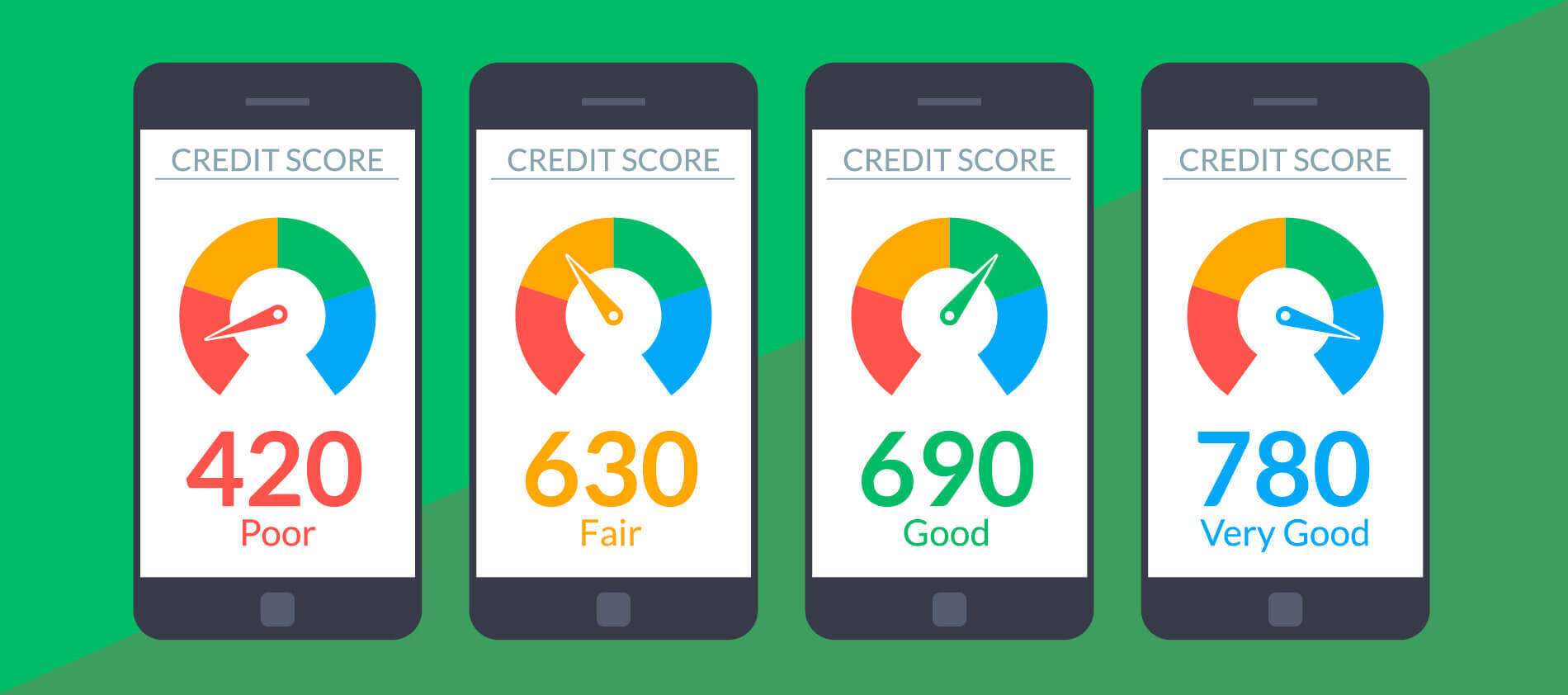

For better or worse, your credit score paints a picture of who you are as a consumer. It proves you are who you say you are – and that you can be trusted to act in a company’s best interests. It’s true that having a low credit score can present plenty of extra barriers or challenges in your life, but can having a less-than-perfect credit score really hold you back in the world of work? Unfortunately, the answer is yes – albeit not always.

Being a single parent family is a unique experience that can be challenging in all sorts of ways. Add financial worries into the mix and it can be a recipe for anxiety, as even the most reasonable of us tend to focus on the necessities, treats and experiences we feel unable to give our children. Over time, this can trigger feelings of guilt, shame and exhaustion.

Credit scores are one small part of life, but they don’t always feel that way. When you have a low score, it can feel like there are big barriers all around, holding you back and stopping you from accessing the things you want or need. This can be frustrating – particularly when you are confident that you’ll be able to afford the repayments.

Here at Fair for You, we want to help you access affordable and flexible credit that is right for you and your circumstances. That’s why we carry out affordability checks as part of our loan application process. One way of carrying out these affordability checks is by asking to see copies of your bank statements. This allows us to gain an insight into your income and expenditure, which helps us decide whether a loan from us will be affordable for you.