Poor Credit Score?

Does any of this apply to you?

- You’re one of the 9.6 million households on a low income

- You’ve been left with bad credit or poor credit history

- You have no credit history

At Fair for You we do credit check, but our decision isn’t only based on credit history.

You may be asked to provide online bank statements through our open bank partner oohMoolah. This is a safe and secure process which helps us make a quick decision on your application. Sharing your bank statements is more likely to result in us being able to grant you the loan you need.

We also like to look more at what kind of payer you are now, and won’t turn you away based on the past.

However, if you are currently struggling with credit you are unlikely to be able to borrow from Fair for You until your circumstances change.

Features of a Fair for You Loan:

-

Start with an easy to manage loan for an item of your choice.

-

Pay it off in flexible weekly, monthly or fortnightly instalments to suit your pocket.

-

Apply for another loan from us after 1/3 of your current loan has been paid off and is up to date

-

Join our Good Payers Club after 6 months of making payments on time to get access to an even wider range of products.

-

Save by making extra online payments at any time to reduce the interest and pay it off faster.

-

Online and SMS Account Management.

to pay in flexible instalments for household items

Customers with Improved Credit Ratings:

“I had terrible credit and usually companies make me dance like a circus animal to get anything but this was simple. I actually feel quite excited about using your services again – it’s so nice to see a company acting with Morals. From application to my new washer arriving I felt highly valued.”

“My washing machine broke down and I wasn’t in a position to purchase one there and then upfront. My credit rating isn’t the best…so I was a bit panicky about finding finance…I thought I would have to go to one of the known home shopping finance stores that charge sky high interest that I would be paying of forever.

Then came across fair for you, it was a Sunday and a bank holiday weekend. It was all dealt with pretty fast and accepted. I had my machine on the Thursday of the same week.”

“I struggled to get credit due to my ex’s mother taking out a load of credit in my name and not paying it off…I’m so so so glad I found fair for you as it means I can have the things I need and want and can pay them off quick at rates that I can afford!”

Making repayments on a loan on time can help people with bad credit to rebuild their credit rating.

And if you are having difficulties repaying you can simply get in touch with us to make changes to repayments when you need to.

So far we have already helped these customers improve their credit rating. Why not apply today and join them?

Karen from Scotland said:

“I could not get credit due to past bad credit history and I felt trapped. I am so happy with the service and can honestly say it’s bettered my life – I feel more in control.”

Chevaun from Bolton said:

“I’ve had a very bad credit rating and with my weekly low payments to Fair for You and never missing a payment has helped my credit score a great deal.

I think that you should promote Fair for You a little more so more people find out about you and can benefit from it.

I’m so happy that I discovered Fair for You.”

To build your credit rating with Fair for You, follow these 5 steps every month:

1. Set up your payment to suit your budget – you can always change this later.

2. Pay at least the minimum payment due on time.

3. Change of circumstance? Tell Us! We’ll sort out a better payment plan and will help you get support.

4. Overpay. Save on interest when you pay your loan off earlier! An added bonus is that if you overpay enough you could take a payment holiday without going into arrears.

5. Only take on debt that you can afford.

Follow these 5 steps and you should be able to see your credit rating improve!

However, not following these steps could harm your credit rating and ability to get more credit elsewhere.

If you do miss a payment, best thing to do is follow these 5 steps as soon as you can to get back on track.

Flexible Repayment Options

We don’t know what life is going to throw at us at any given time, so our loans are flexible.

You pay whatever you can afford in weekly, fortnightly or monthly instalments.

You can also pay ahead (or even a little extra each week) to pay off your loan early to reduce your overall interest.

Make one off online payments here.

If you are ahead with your loan you are eligible to take a payment holiday – but only if you have already overpaid on the loan.

Friendly, Helpful & Highly Responsive Customer Service

You can get in touch with us via our Online Live Chat service on our website.

Email us at contactus@fairforyou.co.uk

Message us on Facebook

Or give us a call on 0333 433 0739.

We are always happy to help so get in touch if you have any questions!

And if you need any help with payments, our Payment Managers are here to support you with your Repayment Plan if ever you need it.

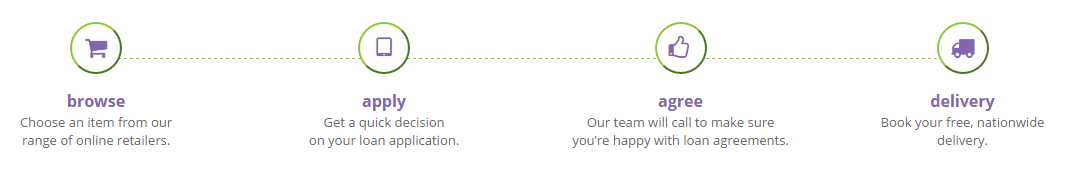

A Quick & Easy Online Application Process

It’s quick & easy to apply for a Fair for You loan.

Note: There is no guarantee that following these steps will increase your credit rating, but doing so should help you to build a strong credit history. Not making payments on time could affect your credit history negatively and stop you from obtaining further credit in the future.